Note

You can download this example as a Jupyter notebook or start it in interactive mode.

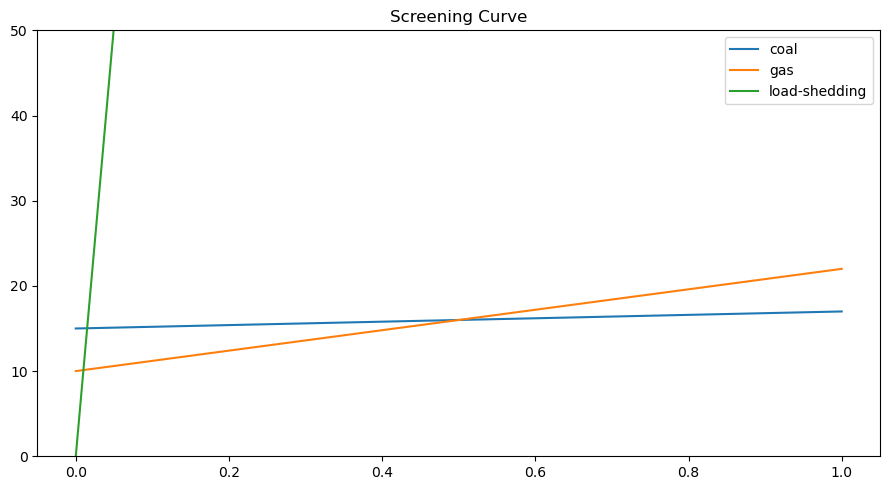

Screening curve analysis

Compute the long-term equilibrium power plant investment for a given load duration curve (1000-1000z for z \(\in\) [0,1]) and a given set of generator investment options.

[1]:

import pypsa

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

Generator marginal (m) and capital (c) costs in EUR/MWh - numbers chosen for simple answer.

[2]:

generators = {

"coal": {"m": 2, "c": 15},

"gas": {"m": 12, "c": 10},

"load-shedding": {"m": 1012, "c": 0},

}

The screening curve intersections are at 0.01 and 0.5.

[3]:

x = np.linspace(0, 1, 101)

df = pd.DataFrame(

{key: pd.Series(item["c"] + x * item["m"], x) for key, item in generators.items()}

)

df.plot(ylim=[0, 50], title="Screening Curve", figsize=(9, 5))

plt.tight_layout()

[4]:

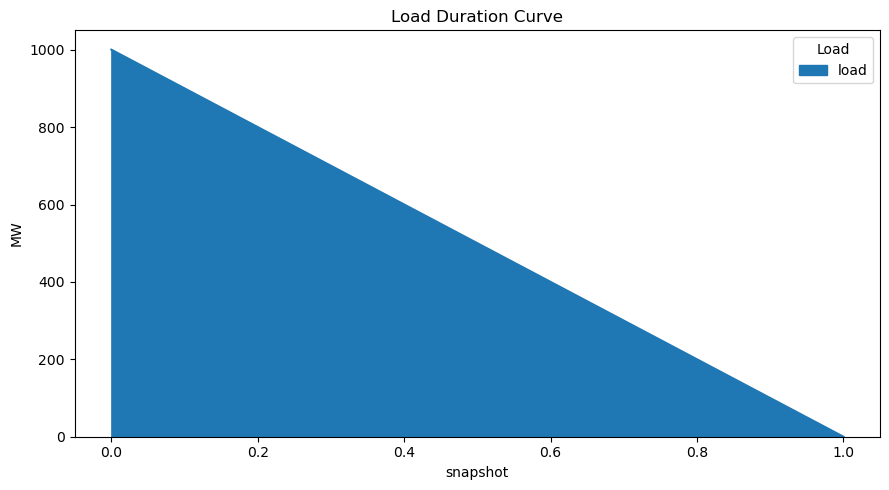

n = pypsa.Network()

num_snapshots = 1001

n.snapshots = np.linspace(0, 1, num_snapshots)

n.snapshot_weightings = n.snapshot_weightings / num_snapshots

n.add("Bus", name="bus")

n.add("Load", name="load", bus="bus", p_set=1000 - 1000 * n.snapshots.values)

for gen in generators:

n.add(

"Generator",

name=gen,

bus="bus",

p_nom_extendable=True,

marginal_cost=float(generators[gen]["m"]),

capital_cost=float(generators[gen]["c"]),

)

[5]:

n.loads_t.p_set.plot.area(title="Load Duration Curve", figsize=(9, 5), ylabel="MW")

plt.tight_layout()

[6]:

n.lopf(solver_name="cbc")

n.objective

INFO:pypsa.linopf:Prepare linear problem

INFO:pypsa.linopf:Total preparation time: 0.14s

INFO:pypsa.linopf:Solve linear problem using Cbc solver

INFO:pypsa.linopf:Optimization successful. Objective value: 1.47e+04

[6]:

14706.191555

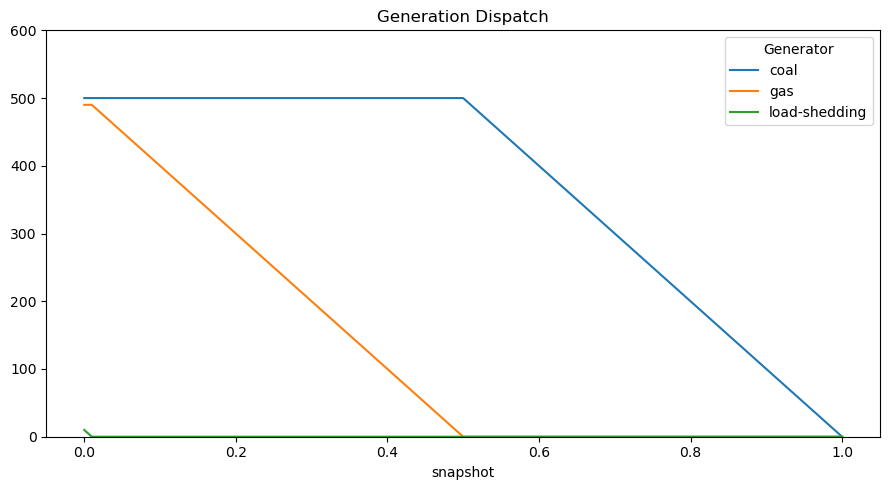

The capacity is set by total electricity required.

NB: No load shedding since all prices are below 10 000.

[7]:

n.generators.p_nom_opt.round(2)

[7]:

Generator

coal 500

gas 490

load-shedding 10

Name: p_nom_opt, dtype: int64

[8]:

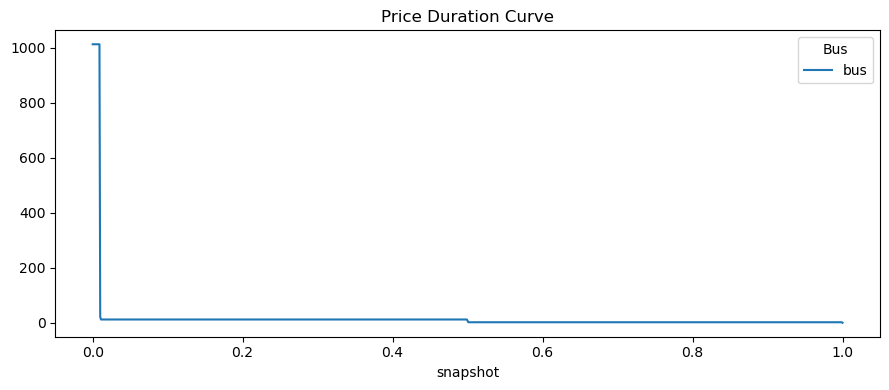

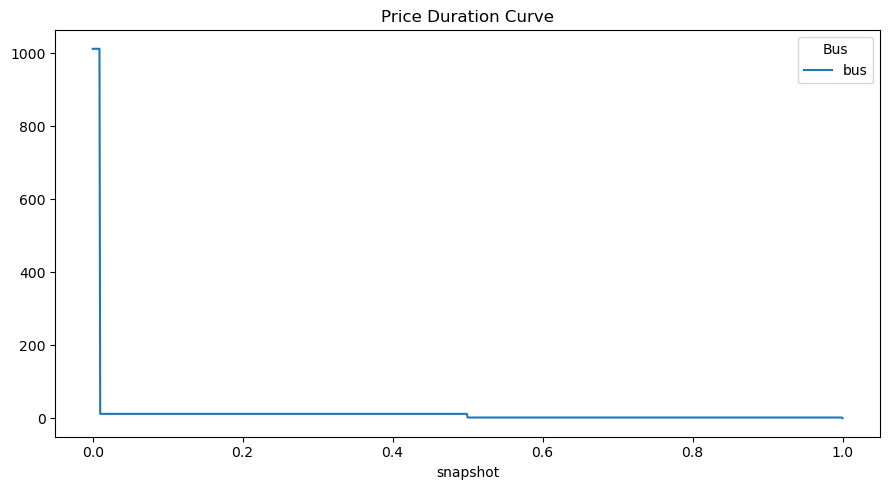

n.buses_t.marginal_price.plot(title="Price Duration Curve", figsize=(9, 4))

plt.tight_layout()

The prices correspond either to VOLL (1012) for first 0.01 or the marginal costs (12 for 0.49 and 2 for 0.5)

Except for (infinitesimally small) points at the screening curve intersections, which correspond to changing the load duration near the intersection, so that capacity changes. This explains 7 = (12+10 - 15) (replacing coal with gas) and 22 = (12+10) (replacing load-shedding with gas).

Note: What remains unclear is what is causing :nbsphinx-math:`l `= 0… it should be 2.

[9]:

n.buses_t.marginal_price.round(2).sum(axis=1).value_counts()

[9]:

2.0 499

12.0 489

1012.0 10

22.0 1

7.0 1

0.0 1

dtype: int64

[10]:

n.generators_t.p.plot(ylim=[0, 600], title="Generation Dispatch", figsize=(9, 5))

plt.tight_layout()

Demonstrate zero-profit condition.

The total cost is given by

[11]:

(

n.generators.p_nom_opt * n.generators.capital_cost

+ n.generators_t.p.multiply(n.snapshot_weightings.generators, axis=0).sum()

* n.generators.marginal_cost

)

[11]:

Generator

coal 8249.750250

gas 6400.839161

load-shedding 55.604396

dtype: float64

The total revenue by

[12]:

(

n.generators_t.p.multiply(n.snapshot_weightings.generators, axis=0)

.multiply(n.buses_t.marginal_price["bus"], axis=0)

.sum(0)

)

[12]:

Generator

coal 8249.749500

gas 6400.837660

load-shedding 55.604395

dtype: float64

Now, take the capacities from the above long-term equilibrium, then disallow expansion.

Show that the resulting market prices are identical.

This holds in this example, but does NOT necessarily hold and breaks down in some circumstances (for example, when there is a lot of storage and inter-temporal shifting).

[13]:

n.generators.p_nom_extendable = False

n.generators.p_nom = n.generators.p_nom_opt

[14]:

n.lopf();

INFO:pypsa.linopf:Prepare linear problem

INFO:pypsa.linopf:Total preparation time: 0.12s

INFO:pypsa.linopf:Solve linear problem using Glpk solver

INFO:pypsa.linopf:Optimization successful. Objective value: 2.31e+03

/home/docs/checkouts/readthedocs.org/user_builds/pypsa/conda/v0.21.1/lib/python3.10/site-packages/pypsa/linopf.py:1173: FutureWarning: In a future version, `df.iloc[:, i] = newvals` will attempt to set the values inplace instead of always setting a new array. To retain the old behavior, use either `df[df.columns[i]] = newvals` or, if columns are non-unique, `df.isetitem(i, newvals)`

pnl[attr].loc[sns, df.columns] = df

[15]:

n.buses_t.marginal_price.plot(title="Price Duration Curve", figsize=(9, 5))

plt.tight_layout()

[16]:

n.buses_t.marginal_price.sum(axis=1).value_counts()

[16]:

1.999998 500

11.999988 490

1012.000990 10

0.000000 1

dtype: int64

Demonstrate zero-profit condition. Differences are due to singular times, see above, not a problem

Total costs

[17]:

(

n.generators.p_nom * n.generators.capital_cost

+ n.generators_t.p.multiply(n.snapshot_weightings.generators, axis=0).sum()

* n.generators.marginal_cost

)

[17]:

Generator

coal 8249.750250

gas 6400.839161

load-shedding 55.604396

dtype: float64

Total revenue

[18]:

(

n.generators_t.p.multiply(n.snapshot_weightings.generators, axis=0)

.multiply(n.buses_t.marginal_price["bus"], axis=0)

.sum()

)

[18]:

Generator

coal 8242.25950

gas 6395.94746

load-shedding 55.60445

dtype: float64